maryland ev tax credit 2022

For updates please email us to. 2022 Chrysler Pacifica Hybrid.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

. 3000 tax credit for. Up to 26 million allocated for each fiscal year 2021 2022 2023. The House is expected to.

The value of the EV tax credit youre eligible for depends on the cars battery size. 2022 Ford F-150 Lightning. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the.

Explore workplace EV charging incentives. Marylanders may be eligible for a one-time excise tax credit. Effective July 1 2023 through June.

The Maryland Energy Administration MEA manages grants loans rebates and tax incentives designed to help attain Maryla nds Goals in energy reduction renewable energy climate. It has already been passed by the Senate. Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023.

Apply for energy-efficiency improvement loans of up to 20000. The time to go electric is now with Nissans Award-Winning Electric Car Lineup. August 11 2022 The federal EV tax credit will change if the Inflation Reduction Act is signed into law.

Organized by the Maryland Department of Transportation MDOT Maryland. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

Get more power than ever with Nissan Electric Vehicles. Electric car buyers can receive a federal tax credit worth 2500 to 7500. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the.

Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at. The credit amount will vary based on the capacity of the. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December.

Ad The future of driving is electric. 2022 Ford Escape Plug-in Hybrid. 2022 BMW 3-series plug-in hybrid.

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. The time to go electric is now with Nissans Award-Winning Electric Car Lineup. The tax credit is available for all electric vehicles regardless of make or model and.

Maryland Home Energy Loan Program. Anticipated Program BudgetThe total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. Clean Cars Act of 2022.

Maryland Launches Tax Year 2022 Energy Storage Income Tax Credit. Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork. This is about 33 percent of the total tax credit allowance for Tax Year 2022.

As of August 16 2022 the program has a total of 249796 available for energy storage tax credit certificates. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Tax credits depend on the size of the vehicle and the capacity of its battery.

Get more power than ever with Nissan Electric Vehicles. The Maryland Energy Administration MEA has opened the application period for the. Ad The future of driving is electric.

10 years of consumer tax credits to make homes energy efficient and run on clean energy incentivizing heat pumps rooftop solar and electric HVAC and water heaters. 2022 BMW X5 plug-in hybrid. Please note the Maryland Energy Administration is currently developing our suite of fiscal year 2022 programs which will be launched as they are developed.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in.

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

Incentives Maryland Electric Vehicle Tax Credits And Rebates

What Evs Qualify For The New Tax Credit Yaa

Electric Vehicle Legislation 2022 Pluginsites

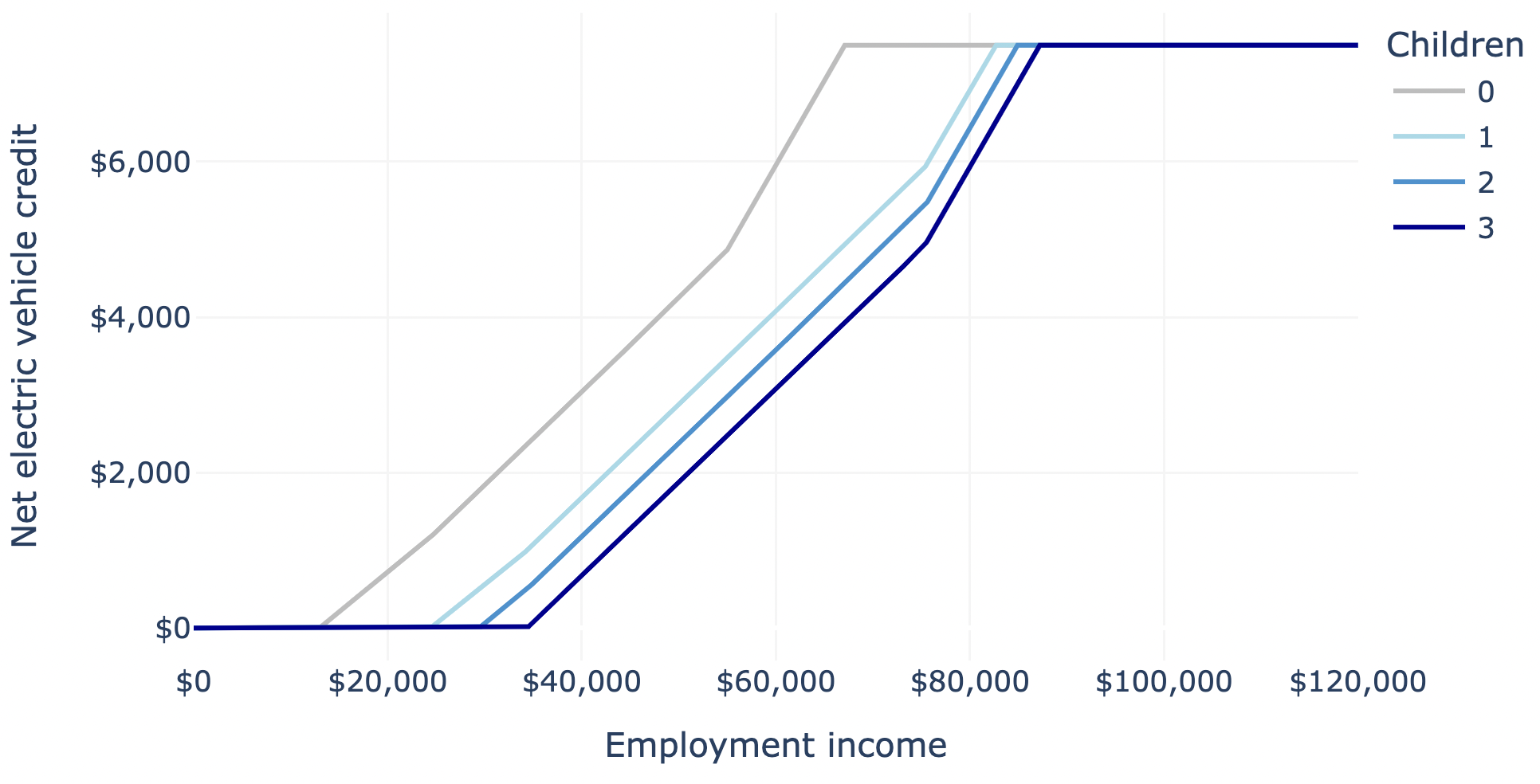

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

Arcimoto Vehicles Reclassified As Autocycles In The State Of Maryland Ultra Efficient Electric Vehicles

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

-Alt-FI.jpg?t=1643677311&width=1080)

Report Evs At Price Parity With Ice Vehicles In 2022 Rto Insider

2022 Chrysler Pacifica Hybrid Minivan Mpg Range More

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Rebates And Tax Credits For Electric Vehicle Charging Stations

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Ev Tax Credit Calculator Forbes Wheels

Arcimoto Vehicles Reclassified As Autocycles In The State

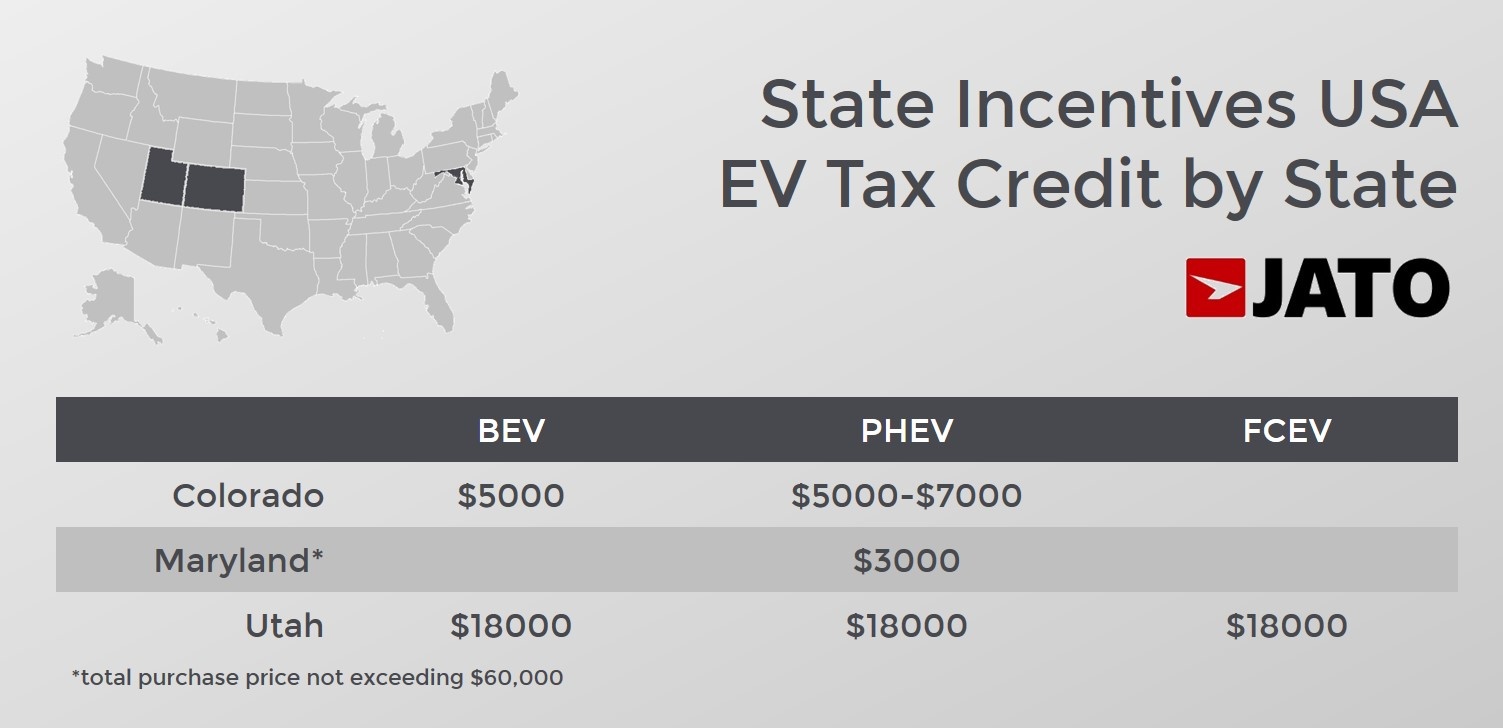

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

.jpg)